5 Reasons Why Automating Manual Journal Entry in SAP Leads to a Faster Financial Close

23-03-2022 5 mins read

The faster pace of finance today, combined with the trend towards moving to a continuous close process, means that accounting cannot keep managing the financial close using manually updated spreadsheets and email-based approvals – it is simply too slow, opaque, and prone to errors. If they want to ensure a fast, accurate close with the necessary levels of transparency and control, they need to digitize and automate.

This blog answers some of the common questions we get asked about how to enable a faster SAP financial close process.

- Why should I automate the SAP financial close process?

- Where should I start to automate the financial close process?

- Can I still use spreadsheets to create manual journal entries?

- How does the process work when I approve a manual journal entry?

- How can I take advantage of real-time information to accelerate my financial close?

1. Why should I automate the SAP financial close process?

According to a 2021 report by SAPinsider, 58% of organizations see financial close as the biggest pain point for financial processing. The report shows that only 30% of organizations have implemented solutions to automate the SAP financial close process, which is far below the automation rates seen in other areas of finance such as Accounts Receivable or Accounts Payable.

Automating accounts payable processes will eliminate the rule-based, repetitive tasks that occupy so much time during financial close. It will give accounting more time to support organizational objectives and:

- Support new business models or operating structures

- Handle increasing transaction volumes automatically

- Orchestrate the close process across multiple legal entities and financial systems

- Enable real-time financial reporting

- Improve compliance and audit readiness

- Support remote work

With automation, digitized information is immediately transparent across your organization and you can get real-time information across multiple business units or financial systems. And the benefits can be even greater if you automate one of the first steps in the process: manual journal entry.

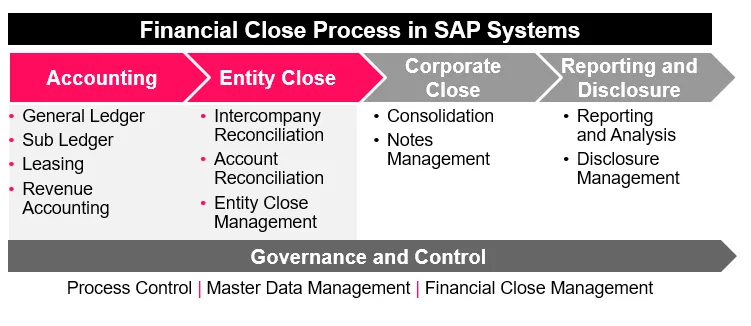

2. Where should I start to automate the financial close process?

Posting journal entries is among the first tasks in the SAP financial close process and, depending on your business, you may have to post hundreds or thousands of manual journal entries in each period. Any delay in entering and approving a manual journal entry will delay all of the activities that follow, which makes it a good place to start when you’re automating.

Using an intelligently automated journal entry tool such as Serrala FS² JournalEntry you can:

- Accelerate data entry with intelligent spreadsheet upload and data validation

- Automatically post any journal entries that meet all required criteria

- Intelligently route journal entry approvals directly to the correct individual

- Enable web-based access to information for anytime, anywhere processing

- Provide real-time reporting and alerting to ensure all journal entries are posted on time

- Enforce compliance requirements, including supporting documentation

- Generate a detailed audit trail for each journal entry from creation to posting

Automating the manual journal entry process will deliver immediate benefits and make it much easier to convince the team to take on more complex financial close automation initiatives in the future.

3. Can I still use spreadsheets to create manual journal entries?

Yes, you can still use spreadsheets to enter the details of your manual journal entries. Serrala FS² JournalEntry provides further capabilities that make the process of entering a manual journal entry easier and more accurate.

- Data Validation: The solution automatically extracts the header and line-item information from the spreadsheet and checks that data against your configured accounting and business rules. It verifies that all mandatory fields are complete and whether there are any errors. Having early, automated validation of manual journal entry data ensures that the entries can be corrected quickly before they are sent for further review and approval.

Manual journal entry data can be validated based on your existing spreadsheet formats, so you don’t have to change the way you do business. You can define specific upload templates for each SAP FI Transaction code to ensure you reach the highest degree of process speed and accuracy.

- Controlled Storage: The solution ensures that each manual journal entry has the required supporting documentation (i.e, spreadsheet and notes) attached and stores the information in an SAP-certified archive repository. Therefore, anyone who needs to review or approve the manual journal entry can access all the information they need and all audit requirements are fulfilled.

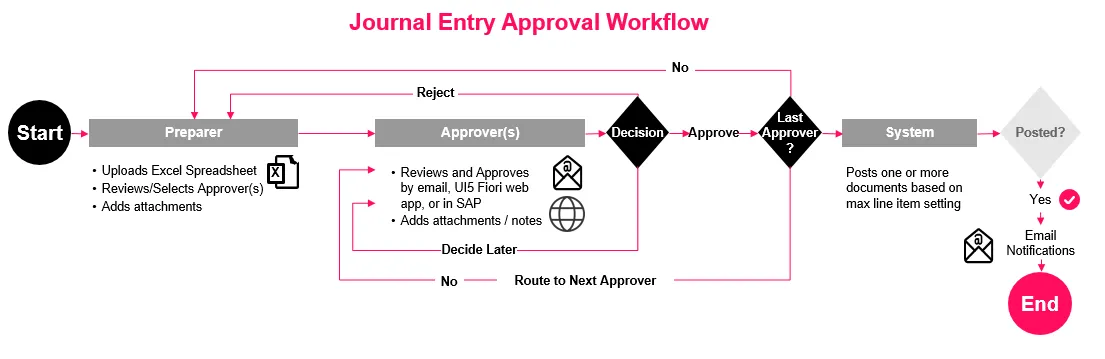

4. How does the process work when I approve a manual journal entry?

Once manual journal entries are created and validated by the Serrala journal entry tool, they are automatically routed for review and approval. The solution uses standard SAP workflows, so you can quickly build approval chains using the authority levels and authorizations that are already set up in your SAP system. Business users can easily tailor the workflow behavior in the solution without IT assistance.

This SAP-centered manual journal entry tool is more efficient because it is:

- Flexible: Approvals can be flexibly routed based on your business’ approval hierarchy structure. You can define different approval chains based on the manual journal entry type, legal entity, or other criteria that are already set up in your SAP system. Approvals, therefore, are always aligned with your corporate accounting policies and procedures. For example, you can use different hierarchies for transactions that impact your balance sheet or income statement. Reminders or escalations can be triggered if the approval does not happen within a defined timeframe or substitute approvers can be used, if the original approver is not available. Configuring your business rules will ensure that a proper segmentation of duties is maintained.

- Secure: All manual journal entry data is kept centrally and securely within your SAP system, instead of buried in spreadsheets or in personal email inboxes. The users’ SAP privileges can be used to restrict the information they are authorized to view. For example, entries that contain confidential information, such as legal journal entries, can only be viewed by authorized individuals. A centralized dashboard and detailed audit trail ensure that accounting always knows who has touched a journal entry from the moment it was created until the moment it is posted and they can easily share this information with auditors if requested.

- Accessible: Users can choose to view manual journal entry data, supporting information, as well as the full approval chain and comments within SAP, or in an email, or in a web browser. They can sort and filter journal entries that require their approval in a central info center and take action immediately. By providing users with more flexible access to information, they are able to review and approve transactions from wherever they are working – in the office or at home – so approvals are done on time.

5. How can I take advantage of real-time information to accelerate my financial close?

Real-time information is essential for organizations that want to keep the time-sensitive SAP financial close process on track. Within FS² JournalEntry, users can see the current status of each manual journal entry. A central Infocenter, detailed reports, and dashboards in the journal entry tool make it possible to:

- Identify & Resolve Errors: The user can track the detailed status and sub-status for each transaction to identify errors and take action quickly. Detecting manual journal entry errors early on prevents incorrect postings and reduces the need for reversals.

- Balance Workloads: With a comprehensive view of all manual journal entries, including intercompany journal entries, it is much easier to see where workloads are heaviest. Real-time reports enable managers to lift and shift work across the team to ensure timely processing.

- Optimize Performance: The ability to accurately measure process cycle time, review missed deadlines, and analyze workload trends across each financial period can help teams optimize their performance. Users can see exactly when and how delays occur, so they can devise new strategies to improve process efficiency and effectiveness.

- Simplify Audits: Audit reporting is much easier when you have detailed information on each manual journal entry. Detailed audit reports can be generated instantly by accounting, with a click of the button. You can also provide self-service information access to auditors, so they can review transactions, supporting documentation, and audit trail details directly in the SAP system. This saves the accounting department time gathering information for auditors and gives the auditors fast and easy access to the information they need.

FS² JournalEntry provides you with real-time information on manual journal entries in one solution across all locations, business units or systems - including non-SAP systems. Having this detailed tracking information is extremely valuable to drive process improvements and identify areas where efficiency or effectiveness can be improved across the entire organization.

Conclusion

The comparatively low level of automation currently used in the SAP financial close process creates a great deal of opportunity for improvement. Automating the creation, review and approval of manual journal entries using the fully SAP-embedded Serrala FS² JournalEntry solution can provide significant benefits: faster data entry, higher data quality, greater visibility, faster approvals, fewer missed deadlines or reversals, and better audit readiness. Automation can also improve job satisfaction for highly skilled accountants, who will have more time to apply their knowledge to support the business to meet the demands of today’s rapidly changing business environment.