Finance and digital maturity in the Post-Pandemic World

Serrala

05-04-2022 8 min read

Three Observations on the State and Future of Work in Finance Organizations.

The pandemic has forced finance organizations around the globe to implement completely new ways of working to ensure business continuity in a climate of extreme uncertainty. Companies had to quickly respond to unforeseen and suddenly changing circumstances that impacted virtually every global business in one way or the other. In many ways COVID-19 has accelerated developments in finance organizations that otherwise would have taken years, if not decades, to unfold – especially in terms of digital maturity. Now the question is: What does this mean for finance in a post-pandemic world?

As the world economy is starting to reset after the global pandemic, it becomes increasingly clear that back to normal does not mean back to pre-COVID. In many ways, the worldwide changes have been so drastic that a return to business as usual has become unthinkable and undesirable. Be it remote working, digital infrastructure, automation or paperless offices – many of the changes we have seen in the workplace over the past months are here to stay. The way forward could be defined by a combination of best practices from pre-COVID with experiences that have proven valuable during the pandemic. In this article we offer three observations on the state and future of finance organizations in a post-pandemic world.

Digital Maturity Prevails in the Face of Disruption

Earlier this year we surveyed a substantial sample of our global community members and asked them how they managed during the pandemic. Which challenges did they face and what did they see lying ahead for them? Responses came from different regions, with the majority of responders residing in North America, and different business departments, including accounts receivable, accounts payable, treasury, payments, but also IT and accounting.

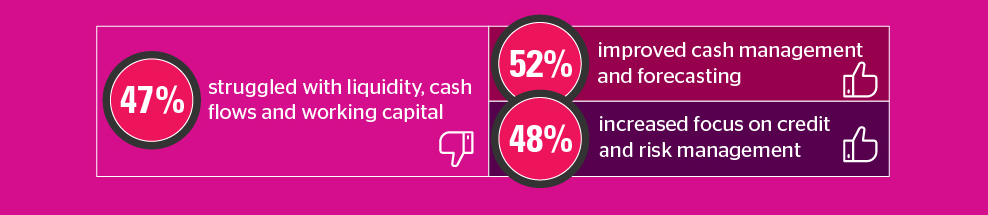

As many predicted last year, reduced liquidity, cash flow, and working capital were challenges for many organizations. Forty-seven percent (47%) stated they struggled with cash flow continuity, making it the number one challenge during the crisis. This resulted in companies shifting their focus more towards cash management and forecasting, as well as credit and risk management. Optimizing cash management and preventing any loss in cash and receivables due to default risks among the customer base, became a top priority.

A major challenge that persists in every finance area, according to our sample, is the prevalence of manual processes. Fragmented and manual operations and procedures were the number one issue for respondents who worked in accounts payable, payments, cash management and journal entry. Only accounts receivable managers saw other challenges as more pressing. Complexities associated with capturing payment formats was the top challenge for AR managers, followed by slow and delayed application of cash, high DSO and payment defaults, and an increase in disputes and deductions.

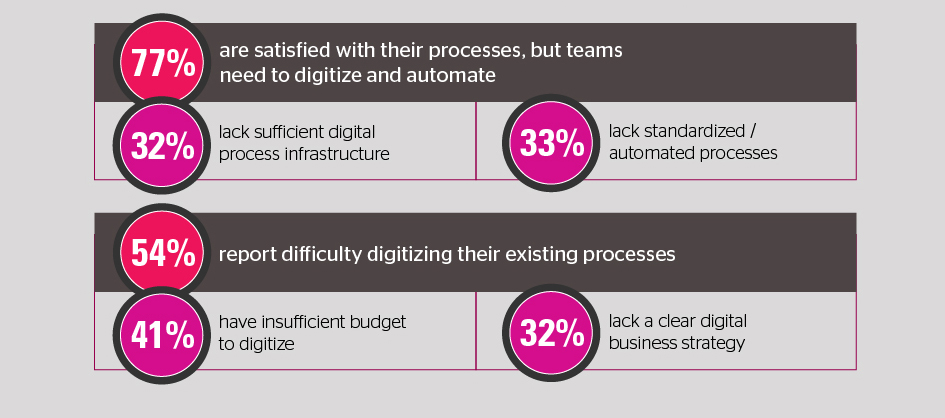

The majority of respondents felt they had successfully come through the crisis. Sixty-two (62%) respondents to the Serrala survey stated that they had sufficient digital infrastructure for remote work and reliable standardized and automated processes. This corresponds with Deloitte’s 2021 Digital Transformation Executive Survey which indicated that companies that are digitally more mature, are more resilient and better equipped to master rapid change and disruption. Clearly, previous investments in intelligent technology and forward-thinking business process design have paid off for these companies, resulting in a certain adaptability and resilience that helped them master the crisis. And the need to invest in digitalization is not going away. Seventy-seven percent of respondents (77%) stated, they will either increase investment in optimizing business processes or invest on the same level as they did pre-COVID.

However, organizations are facing challenges on their journey to digital maturity. Roadblocks include: difficulty changing existing processes (54%), lack of budget (41%), difficulty balancing digital transformation goals with business needs (32%), and compliance concerns (25%).

AI and Humans Working Together for Best Possible Results

Digitization is moving forward, therefore, it is important to look at the technologies that are driving change within the finance organization. The participants of the Serrala survey identified cloud, intelligent automation, machine learning (ML) and artificial intelligence (AI) as the three most important technologies right now. These technologies correlate with the top business priorities for finance organizations: real-time data to power analytics and reducing manual tasks. Both of these business priorities can be addressed using intelligent automation technologies, such as AI and ML.

However, as digital maturity and technology play an ever-greater role in business, new questions about the roles and relationships between humans and technology inevitably arise. As indicated in the findings above, current finance processes constitute a major roadblock for digital innovation. To break through these hurdles, finance organizations need to find ways and build models to integrate these new technological capabilities with human expertise, experience and judgement. The digital enterprise will require new habits, practices and behaviors to re-invent existing processes, functions, and roles.

COVID-19 also made it clear that while technology can supplement and support work in finance, it cannot replace humans altogether. In fact, the pandemic has shown that humans and technology are stronger and more effective together than either would be on their own. What we are seeing in the finance space is not so much technology replacing humans, but humans and technology collaborating to increase value for the organization. Knowledge is more valuable than ever. The notion that “robots are coming for your job”, therefore, becomes obsolete. While some low-skilled, repetitive and rule-based tasks will continue to be automated, most organization want to use AI to assist rather than to replace their highly skilled finance workers. Our survey supports this reasoning, showing that the respondents view strategies to integrate artificial intelligence into teams as a top priority. Similarly, Deloitte’s Global Human Capital Trends survey found that 70 percent of corporates are exploring using AI within their organization.

As AI-Human collaboration becomes more important, we might see work and responsibilities from existing finance jobs being combined into new functions and broaden the scope of the work performed. These new roles will combine the best of what humans and machines can do to improve business outcomes. Take an AR analyst for instance. Instead of manually capturing payment information from remittance advices, lockboxes or checks and looking for the corresponding open post in the accounting system to reconcile the payment, that entire process would be automated. This would open up the analyst to focus on handing any mismatch or exceptions, giving them time to analyze the underlying problem, be it a dispute, deduction, customer complaint or something else. As tedious manual processes are automated in the credit and collections space as well, such as credit data sourcing or writing collection letters, the same analyst could also handle exceptions within credit and collections management, creating jobs with cross-functional expertise.

Another example of combining AI and humans’ complementary abilities would be the application of chatbots. They can assist workers in their communication with customers, suppliers or partners, answering common questions with pre-defined responses that are easily retrievable from existing data. This gives humans more time to handle situations that require more empathy or knowledge.

Clearly, the relationship between technology and people is evolving. Instead of automating processes to replace workers, intelligent automation is being used to augment work, creating new jobs and roles that require workers to collaborate with AI and other technologies. Initially, this evolution will result in reduced costs and improved efficiency. This will be followed by additional transformations in finance, which will further expand the value and opportunity that is possible when humans and AI work together. Most importantly, this collaboration will significantly improve the experience for finance teams and their business partners.

The Office Re-Imagined: Fluidity Could Define the Future of Work

As things are slowly returning to normal in many areas of the business world, returning to the office has become part of a larger discussion about the future of work. In many ways, remote work has been an overwhelming success that has surprised many. Based on this success it will likely be part of future work arrangements for some time to come, possibly permanently. In a study conducted by PwC in November and December 2020, 133 executives and 1,200 office workers surveyed in the US revealed that 83% of employers think that the shift to home offices has worked out well for their company.

However, the office is by no means obsolete. It is most likely going to change. Not even one in five executives want a return to the pre-pandemic office according to PwC. Others are in the process of estimating how widely remote work options will be extended. Only 13% want to actually abandon office spaces altogether. Employees also reflect the same sentiment. Eighty-seven percent (87%) of employees view the office as an important setting to collaborate within teams and to build strong working relationships. However, 61% of employees expect to work only half of their time in the office by July 2021.

The post-pandemic future, therefore, will be defined by a lot more flexibility, with some staff members wanting to return to offices, others abandoning office spaces completely and some making a conscious decision to combine both. PwC found out that 55% of the surveyed employees would like to work from home at least three days per week. Sixty-eight (68%) of executives, on the other hand say they would like to see their employees at least three days per week in the office and emphasized the importance of working in an office to maintain a cohesive company culture. As a majority on both sides do not want to work completely in the office or from home in the future, a more fluid office will define the future of work.

Overall, as organizations embark on re-entering offices, they should seize the opportunity to push the envelope and reimagine how they work. Office re-entry needs to be part of a larger discussion that fully considers what the business will need to be successful: Digital infrastructure, human-AI collaboration, and how all three factors influence and complement one another.

Conclusion: With Recovery Comes New Opportunity

As finance organizations are moving out of the pandemic and into the future, the combined forces of digital transformation, AI-human collaboration and the fluid office will define the months and years ahead. The past year has shown that digital maturity is key to resilience, business continuity and success in times of crisis. This is why market analysts are predicting a near-term surge in enterprise spending to support further digital maturity: Gartner’s 2020 CEO Survey estimates that more than 80% of corporates will increase their investments in digital technologies. They estimate that investments in digital transformation are expected to grow at a rate of 15.5% per year within the next three years, for total of US$ 6.8 trillion.

At the same time, augmenting the work done by humans with AI will make it possible for the finance department to spend more time on challenging and sophisticated tasks. There will be no lack of these tasks in an increasingly complex business and finance environment. By automating repetitive tasks done by human workers with intelligent machines, AI is helping organizations completely re-imagine work. A fluid or hybrid workplace is what most executives and employees want in the future, and it is probably what many companies are heading towards. It is looking more and more likely that employees will be given the opportunity to rotate in and out of offices. These flexible working models are compelling for knowledgeable workers and their managers because they are combining the best of both worlds – the office and work-from-home.

Despite the difficulties of the past few months, many finance organizations could come out of this crisis stronger than they went into it. If they keep making the right decisions, apply lessons learned during the pandemic and continuously challenge the status quo, all signs could be set to thrive in the recovery.

Survey among Serrala customers about the future of finance, 2021

Want to learn more?

Stay informed about new insights and innovations directly from Serrala customers by subscribing to our newsletter today.