Digitization Trends in Finance: Where Do We Go From Here?

23-04-2021 7 min read

Accelerating Digitization in Finance & Treasury

In the past year, finance teams have had to adopt new technology at an accelerated pace. According to a recent McKinsey & Company report the rapid onset of the coronavirus crisis has “speeded the adoption of digital technologies by several years — and that many of these changes could be here for the long haul“i.

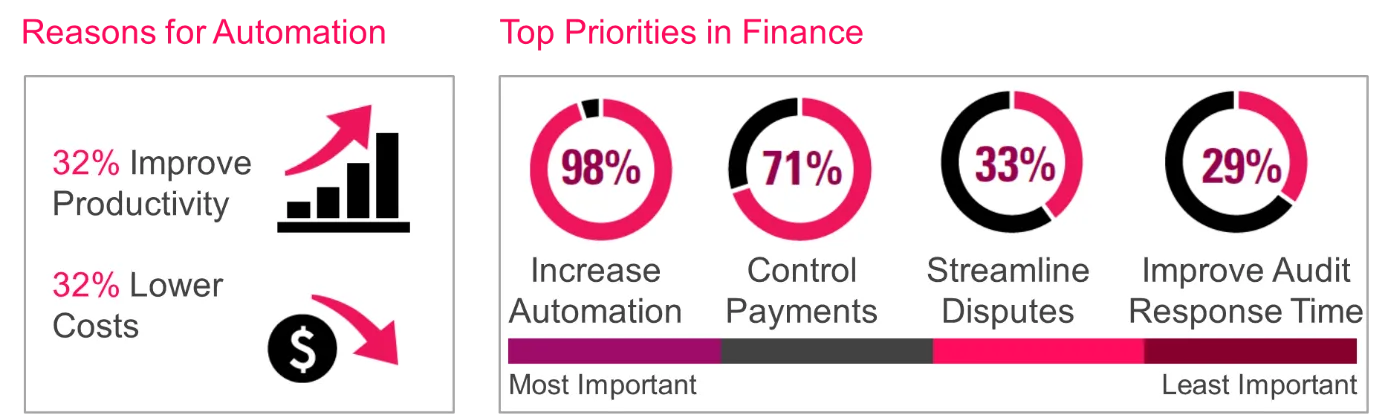

It was only two years ago, a Serrala survey showed that 98% of finance leaders thought that automation was a top priority. Most companies put together long-term plans to improve selected finance processes without a sense of urgency.

However, today, the story is quite different. In April 2020, Serrala asked organizations if they felt that their cash-related business processes and tools meet their needs. Almost half of the respondents said no (42%) . As the end of the year approaches and the crisis continues to have ripple effects across the global economy, the question for many finance and IT leaders is: Where do we go from here?

Rapid Responses to New Challenges

Even though many companies had some degree of automation in place before the crisis, inefficient, manual processes created new challenges once global lock-downs began. To maintain cash flow, members of the AR and AP teams had to scramble to process important customer, supplier, or treasury payments quickly. They had to devise workarounds to bypass any manual and paper-based processes and ensure proper security, data privacy, and fiscal controls. The lack of automation was noticed at the highest levels of the organization. CEOs and CFOs could not get the decision-ready data they needed because it took too long to generate accurate forecasts. As a result, many companies decided to accelerate their plans to digitize their finance and treasury processes, adding technology where it was needed most.

Digital Payments Wherever Possible

LyondellBasell, for example, asked customers to stop sending payments by mail and moved to digital payments wherever possible. Zurich North America quickly augmented its digitized claims process by switching payments from checks to ACH. With a focused team in place, the company was able to start using ACH payments in only six weeks. Remarkably, other Serrala customers, such as Suez Water Technologies & Solutions and Irvine Company completed the rollout of newly digitized AR and AP processes during the lockdown, which enabled them to reach impressive automated processing rates almost immediately.

The rapid responses these companies took in the face of new challenges was impressive. An incredible amount of effort and ingenuity helped them meet the needs of their businesses during the crisis, and it is important to note that technology was an essential ingredient in each case.

Smart Investments in Smart Technology - 4 Technologies for Finance and Treasury

Organizations that want to build on previous process improvement successes will have to continue to explore digitization trends in finance. To deliver long-term value, they will have to choose options that solve more than just their immediate processing pain points. They will have to invest in new technologies that will improve the flexibility and resilience of the entire company. Here are four ways to make smart technology investments for the future.

1. Move to the Cloud

Cloud technology has been popular for more than a decade, but not all companies were ready to move to the cloud until recently. This was primarily due to perceived issues around security and scalability. Today, many companies are taking a cloud-first approach to enterprise systems. Some ways to move to the cloud include:

-

Digitize supporting documents used by finance and treasury processes. By going paperless, companies can reduce storage costs, increase processing speed and make access to information much easier for global teams.

-

Extend or enhance processes using cloud-based extension apps. SAP has taken this approach, using the SAP cloud platform to deliver innovative functionality on top of the SAP « digital core ». Even if you’re not using SAP as your system of record, adding new capabilities in the cloud is a good strategy that will enable greater process flexibility.

-

Take advantage of business intelligence and artificial intelligence capabilities in the cloud. The cloud is a natural fit for these technologies because it is possible to process large volumes of data quickly and to provide users with consistent global access to information.

2. Achieve the Next Level of Process Automation

A recent report by SAPinsider indicates that around 50% of companies have already adopted some form of automation. Yet, the crisis has shown there is still a lot of potential to increase process efficiency.

AI-enabled automation, which uses self-learning algorithms can:

-

Explore data connections, identify patterns and discover relationships much faster than humans.

-

Support users by identifying and suggesting the next possible steps in complex approval and exception handling workflows.

-

Accelerate and enhance financial planning and forecasting.

For examples of how to apply intelligent automation, the recent IT Market Clock for Procurement and Strategic Sourcing Applications 2020 by Gartner Inc. reviews some examples of how AI-enabled automation can improve P2P processing. You can download the report here.

3. Make Agile Decisions with Fast and Flexible Analytics

Analytics is an important tool that provides users, particularly busy executives, with important, at a glance details about the organization. This year, organizations recognized there was a need for faster and more flexible analytics to support agile decision making. To succeed companies must:

-

Minimize your reliance on spreadsheets. Spreadsheet-based reports are difficult to update and maintain, especially when market conditions are changing rapidly. The process of manually collecting and updating data from various sources (i.e., banks, different business divisions) makes spreadsheets error prone and unreliable and insufficient for today's fast-moving digital world.

-

Review your customized reporting solutions. Customized solutions have limitations: they are difficult to adjust without IT assistance and, without integration with all relevant data sources, may use limited or incomplete data sets. These shortcomings make them less useful for fast, accurate reporting that CFOs will need in the future.

-

Maximize the use of built in reporting and analytics capabilities available with your ERP system. Working with data directly from your system of record will ensure you are working with the most accurate and real-time information. SAP and other ERP systems have many built-in capabilities that will provide a broad and rich user experience and enable you to take advantage of the latest artificial intelligence to improve analysis and discovery.

In a recent CFO Playbook event, Serrala experts David Hobler and Nina Luh provided an in-depth view of the analytics needs across the entire finance organization and how you can leverage the capabilities of Serrala Analytics. You can read their blog: Top 10 Tips to Improve Transparency for the CFO here.

4. Automate and Standardize with Software as a Service

In 2020 Finance and IT teams spent a lot of time helping the business “keep the lights on”. They did not have the time or resources to plan and execute large strategic projects with complex business and technical requirements. Unfortunately, this is not likely to change in the future. This is where Software as a Service (SaaS) comes in. It can:

-

Standardize and automate business processes. In finance, for example, bank connections, payment formats, supplier evaluation forms, and approval workflows are very similar across businesses in every industry. Therefore, using a SaaS solution provides organizations with a best-in-class solution with minimal overhead.

-

Enable innovative capabilities. SaaS solutions are developed and supported by process and technology experts. As a result, your organization can benefit from the latest capabilities, such as fraud monitoring, without requiring extra software licenses or implementation efforts.

-

Give your finance and IT teams more time to provide other valuable services. Because SaaS solutions keep processes standardized, automated, and up to date, your team will have more time to help build stronger customer and supplier relationships, negotiate favorable discounts and bank fee schedules, and provide strategic services to the rest of the organization.

The financial benefits of moving software from a capital to an operational expense is often the biggest argument for using SaaS solutions; however, the greatest return on investment will likely be from the extra value your team can deliver when using the standardized, modern processes.

Build a Roadmap!

Whatever the future may hold for your business, expanding the technology capabilities of your finance organization will be a wise investment and a key factor for your success. Spend time investigating the available options and rely on trusted partners to advise you in choices that will maximize your return on investment. Based on that information you can build a future roadmap that will help you accelerate your digitization to show you exactly where you need to go.

i How COVID-19 has pushed companies over the technology tipping point—and transformed business forever, McKinsey & Company, October 2020.

ii Serrala Future of Finance Survey, June 2018

iii Serrala Finance and Treasury in Times of Crisis Survey, April 2020

Don’t miss out!

Serrala optimizes the Universe of Payments

for organizations that seek efficient cash visibility and secure financial processes.