Reducing AP Cost: Unlocking Efficiency and ROI with AP Automation

5 minutes read

Published on 16-06-2023

The proof of the power of automated Accounts Payable (AP) is in the ROI evidence. Even the most effective Account Payables departments cannot stem the flow of cash outlay and lost time incurred by inefficient processing practices. In fact, AP efficiency and AP cost are driven foremost by the degree of manual work this business practice requires. AP is recognized as the most time-consuming, laborious and paper-intensive finance process for most organizations. The top drivers of making the move to AP Automation according to SAPinsider include:

- Streamlined workflows and reduced manual processes across systems (56%)

- Electronic tracking and management of invoices (55%)

- Insufficient automation leading to manual work and manual processes (29%)

- Business growth and evolution (28%)

- Pressure to reduce payment errors, fraud risks, and security breaches (26%)

Manual Processing Inflates AP Cost

Achieving more efficiency while reducing operational AP cost is one of the main drivers for automation. Research has found the average cost to process a single vendor invoice can be up to $15, and yet organizations that have moved to adopt systems of AP automation experience significant AP cost savings – anywhere from 60-80% above manual processing, bringing the average invoice cost down to $5 or less. There’s also the cost of what is overlooked with manual processes. Many companies capture discounts from less than 20% of their suppliers, and the fraud costs associated with manual methods can decimate budgets. The higher the percentage of manual processes in use, the greater the likelihood of payment fraud occurring.

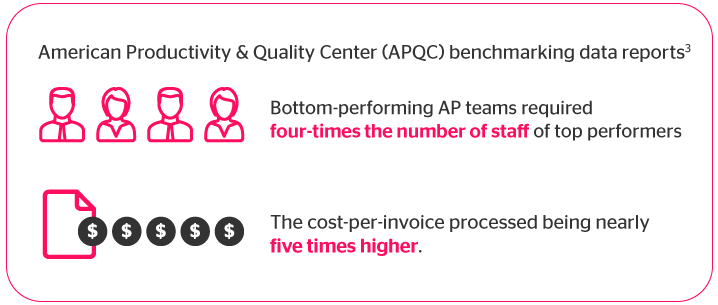

And the price of not automating doesn’t end with missing significant AP cost savings. Bottom-performing companies that process more invoices manually also face longer invoice approval times and more exceptions than their peers. Lack of automation is not only reflected in staffing needs, it also ripples out into the quality of talent you engage, since most workers would prefer to seek employment opportunities with forward-looking companies engaged in digital practices and innovation. Today’s general lack of “digital maturity” among most organizations ― only 4% of current organizations operate in a fully digitized and automated workplace ― prevent younger workers from realizing more fulfilling positions.

Manual processes are particularly error-prone (think inaccurately-coded line items and simple key-in mistakes) and open to delays, which is detrimental to consistent cash flow management and forecasting. Without a streamlined and efficient accounts payable process, there's no guarantee that vendors will be paid in a timely manner or that it will be possible to detect and prevent fraud before it happens. Disjointed, fragmented processes that involve multiple layers of approvers also impact your customer’s business, their future ability to collaborate with you, and your capacity to remain competitive.

Measuring AP Automation ROI in the Real-Time Lost

Next to AP cost, one of the most readily visible KPIs of automation is the increased speed of invoice processing. Replacing repetitive hands-on tasks reclaims the lengthy time required to perform each step in the process, from capturing invoices to validating data, matching invoices to purchase orders and goods receipts, and lastly posting the invoices so vendors can be paid. Every minute that can be saved by increasing AP efficiency will increase the potential AP Automation ROI.

In the 2022 “State of Digital Maturity: Advancing Workflow Automation,” data finds 51% of workers spend at least two hours per day on repetitive tasks. That’s precious time they could be spending on more value-added activities like applying their skills to advancing a company’s products and services. In a Business Insider report, 49% of office employees stated they were unable to leave work on time due to difficulties with everyday administrative tasks that could be automated.

Boredom is also a key consideration and not only because it leads to burnout; it also results in significant demotivation and lack of productivity. Automation technology offers a path forward by signaling to employees that their organization is interested in them and their job trajectories. Investing in tech tools and training, and creating focused initiatives aimed at upskilling creates a positive work environment that is looking towards the future and bringing its workforce along to keep pace.

When performed by your AP team, manually-intensive work not only incurs hours of effort, the volume, inconsistent format, processes and information available across multiple remittance details and accounts means more room for errors, delays, and miscommunication. Consider that 67% of teams manually key invoices into their ERP/accounting software with an average time of 10 days to process an invoice and even error-free input demands time and resources that could be spent elsewhere.

It is also a norm in accounts payable for vendors to submit multiple copies of an invoice through different channels to accelerate the time to payment. For example, a vendor may submit the same invoice by mail and electronically. However, this practice creates a growing volume of duplicate invoices that can create a backlog within the AP team, resulting both in higher processing costs and lower productivity.

Furthermore, when additional interaction is required to answer supplier queries or disputes, more delays ensue. Without automated solutions to detect and reject duplicate or incorrect invoices, or to streamline time-consuming vendor communications, AP departments are forced to navigate through layers of miscommunication, which places an unnecessary strain on vendor relationships and erodes trust. Introducing automated solutions that can capture and process machine-readable (digital) invoices will reduce these workloads and increase data accuracy rates into the 90%+ range.

Why Reducing AP Cost is Fundamental to Business Success

Being able to manage a higher volume of functions that were once manual also paves the way for companies to be more flexible and grow. Automation is the key to optimizing productivity, employee experience and effectiveness, and ultimately providing the means to sustainable growth.

Using the potential AP cost and time savings, industry benchmarks and metrics, and the across-the-board value of investing in advanced technology the resulting ROI data makes a convincing case for AP Automation.

Start Calculating AP Automation ROI with the Serrala AP Savings Calculator

Interested in exploring the potential for time and AP cost savings? Learn how our Serrala Accounts Payable Automation Savings Calculator with a few simple inputs allows you to determine your possible savings and use this information as part of your return on investment analysis for AP Automation.

Related content

Unleashing the Power of AI: Finance Automation for CFOs

Join us for an exciting webinar series as we delve into the transformative potential of AI in the finance world, hear insights and discover lessons on integrating AI into the financial landscape.

Jabil and the secret to automating 2 million invoices annually through AP automation

Award-winning solutions for financial automation

As pioneers in financial automation, Serrala offers a highly powerful and flexible suite of solutions that have successfully empowered finance teams all over the world to optimize and modernize their financial processes.