Invoice to Pay – Achieve Full Visibility and Automation

Optimize Cash, Capture Discounts and Manage Fraud

Visibility across the invoice to pay process is essential for controlling your outbound payments as well as your cash flow planning and cash forecasting. However, manual steps and decentralized interactions with suppliers and internal stakeholders can create critical process gaps, which introduce errors, delay supplier payments, and create opportunities for fraud.

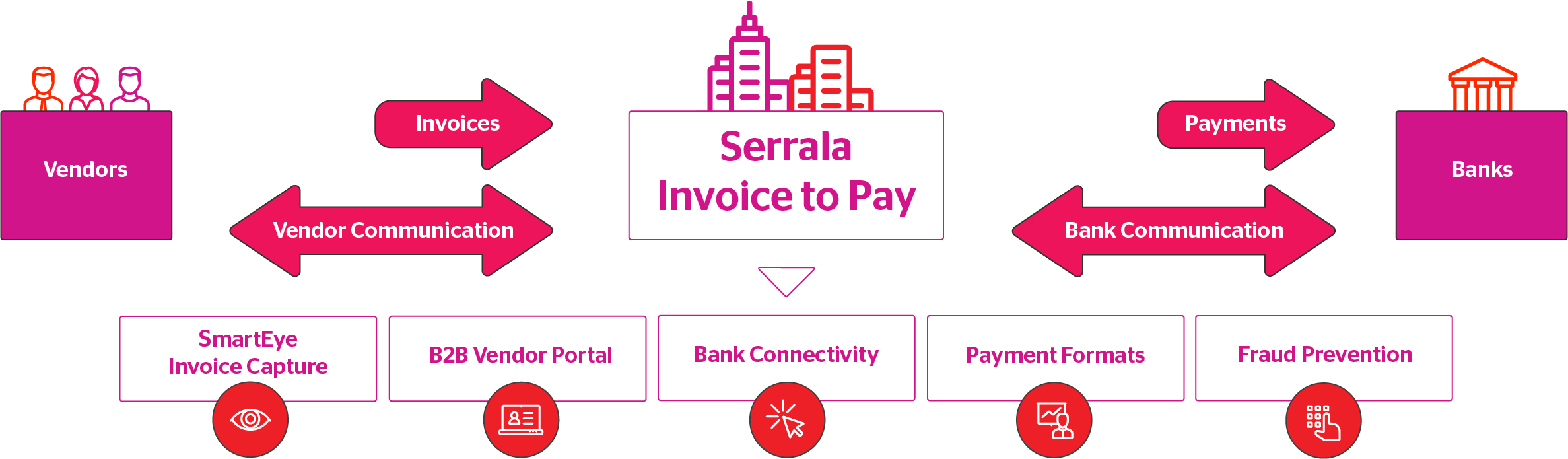

Transform your accounts payable and payment activities into an end-to-end Invoice to Pay cycle with the SAP, Cloud or Hybrid solutions from Serrala. Our best award winning, fully digitized and automated software solution, streamlines processing from the time an invoice is received until the payment is executed.

Explore the Advantages of Serrala Invoice to Pay Solutions

Increase process control and manage your accounts payable automation with the Serrala invoice to pay. Improve process speed and accuracy with intelligent invoice capture and a self-service portal that provides your vendors with real-time invoice status updates and streamlined communications. Process invoices quickly and accelerate payments with intelligent workflows, direct connections to your banks and automatic payment formatting. The solution intelligently monitors every transaction for potential fraud.

Next-level Automation and Security: AP and Payments

In this on-demand webinar, explore the Serrala invoice to pay solution in more detail. Using a real-world case study, our experts will review the solution capabilities and flexible deployment options that enabled the organization to achieve:

-

Extremely high rate of electronic invoice capture

-

Greater visibility into outbound payments across the organization

-

One-click access to transaction history and supporting information

-

Simplified processing of manual payments for vendors and personnel

How GNS achieved 100% visibility into invoices and payments

GNS, the world leading supplier of casks for spent fuel, contained its payment costs using an invoice-to-pay solution from Serrala. It achieved a single unified view from initial invoice capture until payment execution, so it could reduce its processing costs and increase payment security and compliance. According to Jennifer Schurai the solution creates „a beautiful interface between accounts payable and finance department, where payment transactions take place.“

Capabilities to Transform Your Invoice to Pay Process

- End-to-end Visibility for Invoices and Payments

Achieve a full view of all your invoices and their payment status in a centralized hub. With information at your finger tips, you can answer supplier queries in seconds and take action based on real-time information to improve your cash management and cash forecasting. - Highly Accurate Digital Invoice Capture

Capture invoices quickly and accurately with a cloud-based service that eliminates manual processing of paper invoices. The digital invoice capture service provides immediate visibility into supplier spend and enables extremely high touchless invoice processing rates. - Intelligent Process Automation

Enable straight through invoice processing and instantly optimize and execute payments with intelligently automated workflows. Define business rules to increase your processing speed and efficiency at every step and keep information flowing seamless from your payables automation into payments automation. - Anytime, Anywhere Access to Information

View invoice or payment information using the same solution, whether you’re in the office or elsewhere using a web browser or mobile device. Securely review detailed transaction information and take immediate action to ensure timely invoice approvals and payment.

- Fraud Monitoring for 100% of Outbound Payments

Ensure smart, effective fraud prevention with rule-based checks for up to 100% of your payment transactions. Consistently monitor your outbound payments to check payment frequencies, beneficiary details, amounts, data changes and more, and flag suspicious payments for further review based on your business’ fraud requirements. - Automated Payment Optimization and Formatting

Simplify global payment processing and spend more time on strategy with intelligent workflows that route payments for review and approval and optimize payment runs by bank, currency, and vendor. Use our cloud-based service to formats payments according to the latest standards and bank-specific requirements. - Seamless Connectivity with Vendors and Banks

Improve the speed and accuracy of your invoice-to-pay process with direct connections to your Supplier Networks and Banks. Offer your vendors self-service portals and manage payments and bank communications centrally to increase control and visibility. - Advanced Reporting and Analytics

Analyze your invoice-to-pay process from start to finish with an integrated set of reports, dashboards and KPIs. Measure the number electronic invoices you auto-post, identify available discounts, and optimize your payments runs to reduce bank fees and hold onto cash longer.

Using solutions that share common navigation and a common data model drives user adoption, increases efficiencies and delivers greater value for all stakeholders across the entire invoice to pay process.

250%

increase in B2B fraud attempts in the past two years

90%

of best-in-class enterprises view AP data and intelligence as important or critical

71%

of organizations want insight into payments for cash flow analysis and forecasting