Serrala Best of Industry Experts 2021

20-12-2021 15m read

Data from global experts reveals a shift in strategic goals and priorities across finance

Over the past year, Serrala hosted a series of respected industry experts, asking them how companies are faring a year after the start of the global pandemic. Amazingly, their data shows that while many companies are still feeling some effects, they are ready to move from reactive mode to making proactive changes for the future .

From accounts receivable, accounts payable and payments, to credit and collections through to treasury, these experts have uncovered the key strategies global finance leaders are using to confidently manage their way through the crisis. Click on the expert's name to watch a video of their session or read our brief summary of their insights below.

Build a culture of cash excellence to improve cash forecasting

Jakob Rüden of McKinsey and Paul Nicolson of EuroFinance explained that the crisis has dramatically increased the importance of cash forecasting. In fact, three quarters (74%) of treasury professionals reported that they increased their focus on cash forecasting during the crisis, and 54% plan to prioritize cash forecasting in the future. However, to ensure forecasting success, companies must build a culture of cash excellence, which extends beyond finance into every part of the organization. According to Rüden, this starts with CFOs who should ensure that everyone, from production to sales, understands how they can contribute. For example, cash rich organizations might want to offer their suppliers early payment in exchange for a discount. This way, the organization can effectively use its liquidity to strengthen its supply chain. CFOs can use dashboards and KPIs to show each area of the business how their performance affects corporate cash and liquidity, thus motivating them to maintain consistent cash excellence.

Jakob Rüden of McKinsey and Paul Nicolson of EuroFinance explained that the crisis has dramatically increased the importance of cash forecasting. In fact, three quarters (74%) of treasury professionals reported that they increased their focus on cash forecasting during the crisis, and 54% plan to prioritize cash forecasting in the future. However, to ensure forecasting success, companies must build a culture of cash excellence, which extends beyond finance into every part of the organization. According to Rüden, this starts with CFOs who should ensure that everyone, from production to sales, understands how they can contribute. For example, cash rich organizations might want to offer their suppliers early payment in exchange for a discount. This way, the organization can effectively use its liquidity to strengthen its supply chain. CFOs can use dashboards and KPIs to show each area of the business how their performance affects corporate cash and liquidity, thus motivating them to maintain consistent cash excellence.

Adopt a growth mindset to accelerate digital transformation

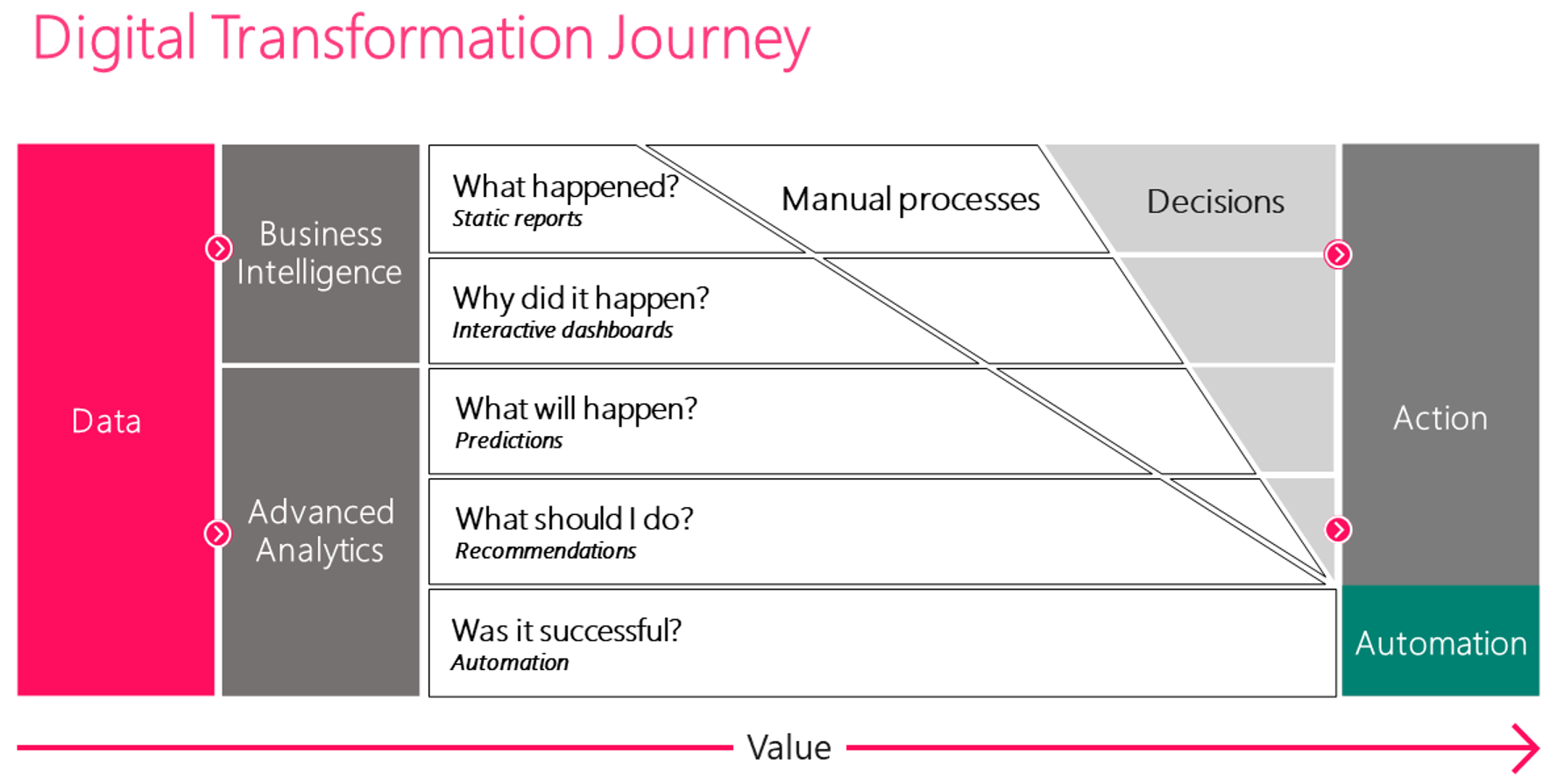

Nicola Boschetti, CFO of Microsoft Italy, shared insights on his company’s evolution to a fully digital, cloud-based finance organization.

According to Boschetti, a key part of the Microsoft “one finance” strategy was to use Microsoft Azure to build a unified data and reporting platform, creating a single source of truth for finance information across the organization. Now, the global company has all of its finance data online. The data is always up to date, so everyone in the organization has the potential to get what they need to make decisions. The platform also makes it possible to use ML and AI technology to do advanced analytics that look forward and generate recommendations that drive actions and accelerate automation. When asked why finance leaders should start their digital transformation now, Boschetti said that adopting a growth mindset is essential because “business is changing at a pace that is much faster than in the past… - we need to embrace the right tools to do everything we can to be in the front of the line.”

3 Priorities in GBS: process excellence, automation & data analytics

Naomi Secor of Shared Services and Outsourcing Network (SSON) reviewed their latest research on Global Business Services (GBS) organizations. In the short-term, SSON data shows that digitizing GBS operations and managing cost remain top priorities. However, the long-term plan is to look beyond transactional processing to deliver more value-add services. More than half (61%) of GBS organizations listed end-to-end process management as a top priority for the future. According to Secor, they will achieve this by maintaining a strong focus on process excellence, increasing the level of process automation, and developing data analytics competencies. With this comprehensive process optimization approach, GBS staff members will be able to focus on more valuable tasks, resulting in more rewarding jobs, which will continue to attract new talent for these critical back-office roles.

Naomi Secor of Shared Services and Outsourcing Network (SSON) reviewed their latest research on Global Business Services (GBS) organizations. In the short-term, SSON data shows that digitizing GBS operations and managing cost remain top priorities. However, the long-term plan is to look beyond transactional processing to deliver more value-add services. More than half (61%) of GBS organizations listed end-to-end process management as a top priority for the future. According to Secor, they will achieve this by maintaining a strong focus on process excellence, increasing the level of process automation, and developing data analytics competencies. With this comprehensive process optimization approach, GBS staff members will be able to focus on more valuable tasks, resulting in more rewarding jobs, which will continue to attract new talent for these critical back-office roles.

Improve customer experience by accepting new payment methods

Yessine Alvarez of Credit Research Foundation (CRF) in the US discussed recent trends in Accounts Receivable. According to CRF data, there has been a rise in collections effectiveness, from 81.5 in 2020 to 87.00 in 2021, and a reduction in DSO from 41.56 in 2020 to 37.71 in 2021, which is a good signal of a recovery. From a payment perspective, CRF members say that providing payment flexibility is key and an essential part of the customer experience. The major payment methods continue to be ACH, credit cards and checks and the choice of payment methods tends to be industry specific and customer driven. Alverez notes that they have seen an increase in multiple payment acceptance, including B2C solutions such as Venmo and PayPal.

Manage credit risks by partnering with sales & procurement

According to Ludo Theunissen of FECMA, the European Federation of Credit Associations, large, mature companies were much better prepared against the crisis because they had built up huge reserves. With more cash, they were able to support their customers with payment plans and longer payment terms. However, all companies can benefit from good credit and collections management processes right now. As government covid measures come to an end, insolvencies will likely increase. Credit managers will have to predict, manage, and handle customer insolvency risks and track related suppliers and competitors. Having centralized data is a start but credit managers should strive to become a preferred partners of sales, procurement and other internal stakeholders to protect their organization from risk.

Fraud risk is increasing – use a suite approach to close process gaps

We discussed the biggest trends and predictions in accounts payable for 2022 with Andrew Bartolini of Ardent Partners. According to their research, companies saw a 250% increase in B2B fraud attempts over past two years. The rising risk of fraud and the needless inefficiencies created by manual and disjointed processes is why 62% of organizations are taking a suite-approach to digital transformation. According to Bartolini by streamlining AP and Payment workflows and “using solutions that share common navigation and a common data model”, companies can drive user adoption, increase efficiency and deliver greater value for all stakeholders.

We discussed the biggest trends and predictions in accounts payable for 2022 with Andrew Bartolini of Ardent Partners. According to their research, companies saw a 250% increase in B2B fraud attempts over past two years. The rising risk of fraud and the needless inefficiencies created by manual and disjointed processes is why 62% of organizations are taking a suite-approach to digital transformation. According to Bartolini by streamlining AP and Payment workflows and “using solutions that share common navigation and a common data model”, companies can drive user adoption, increase efficiency and deliver greater value for all stakeholders.

Treasurers must build Strategic relationships in 2022

Tom Hunt of AFP, the US-based Association of Finance Professionals, and Thomas Schräder of PwC joined us to review recent trends in treasury transformation. In 2021, cash flow forecasting remains a top priority, but the role of the treasurer is changing rapidly, according to PwC. CFOs are asking treasurers to act as a business partner who works with stakeholders across the organization to enhance the entire value chain. Talent management is also important. Today’s treasurers need to be able to think strategically and build relationships within the organization and with partners, particularly as they are asked to support M&A activities. AFP agrees: eighty-four percent (84%) of companies said that having the right people is essential for getting through the next crisis. While each treasury transformation is unique, investing in training and technology that supports the expanded role of the treasurer will help them keep large multi-national companies running from the office or their kitchen table.

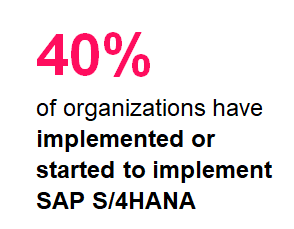

Majority of organizations will evaluate SAP S/4HANA in 2022

Riz Ahmed of SAPinsider provided insights from recent research into automation in finance and SAP S/4HANA. According to the “SAP S/4HANA and Central Finance: State of the Market Benchmark Report” from May 2021, 40% of organizations have either implemented, are implementing or are running pilot projects for S/4HANA. While the pandemic likely delayed the transition to S/4HANA for many companies, the return to normal means that more than 50% will start the S/4HANA evaluation process shortly. Ahmed, noted that finance leaders will benefit from the intelligent automation capabilities and advanced analytics available on the HANA platform. SAP-certified solutions such as FS² from Serrala, can help organizations realize the benefits of automation now, and maintain those benefits throughout the transition to S/4HANA.

Riz Ahmed of SAPinsider provided insights from recent research into automation in finance and SAP S/4HANA. According to the “SAP S/4HANA and Central Finance: State of the Market Benchmark Report” from May 2021, 40% of organizations have either implemented, are implementing or are running pilot projects for S/4HANA. While the pandemic likely delayed the transition to S/4HANA for many companies, the return to normal means that more than 50% will start the S/4HANA evaluation process shortly. Ahmed, noted that finance leaders will benefit from the intelligent automation capabilities and advanced analytics available on the HANA platform. SAP-certified solutions such as FS² from Serrala, can help organizations realize the benefits of automation now, and maintain those benefits throughout the transition to S/4HANA.

Want to learn more about the latest trends in finance and treasury? Sign up for our newsletter and get updates on our next industry expert sessions.