E-Invoicing Revolution: Navigating the New Era of Global Compliance

FS² AccountsPayable

What is e-Invoicing?

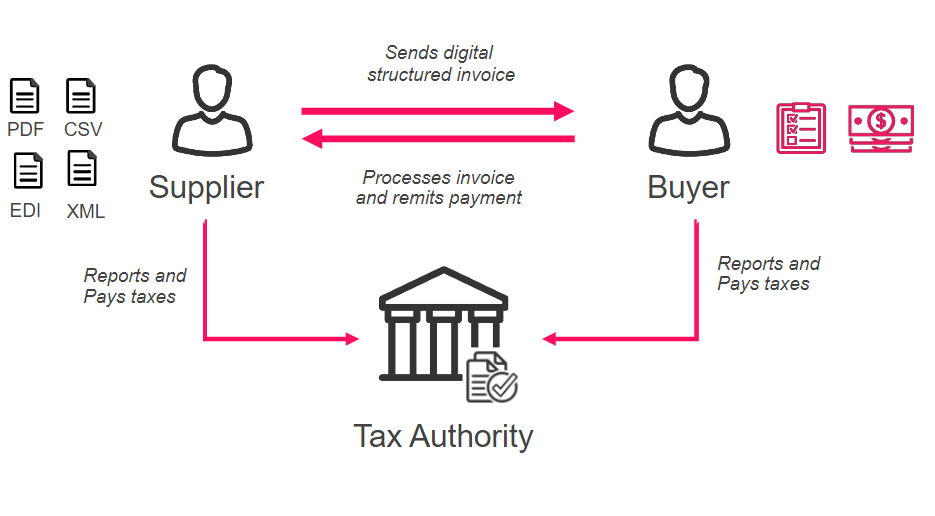

E-invoicing, short for electronic invoicing, refers to the digital exchange of invoices between a supplier and a buyer. Instead of traditional paper-based invoices, e-invoicing involves sending and receiving invoices electronically, typically through electronic data interchange (EDI), email, or specialized invoicing platforms. E-invoicing streamlines the invoicing process, reducing manual errors, saving time, and facilitating faster payment processing. It also enhances transparency and compliance with regulatory requirements in various jurisdictions. Vendors, or suppliers, use e-invoicing to efficiently manage billing processes, improve cash flow, and strengthen relationships with customers by providing accurate and timely invoices electronically. It has been in use since the mid1960s.

E-invoicing mandates, take e-invoicing a step further, as governments strive to enhance tax collection and streamline tax reporting processes. E-invoicing mandates are comprised of the format, required content, and exchange requirements between businesses according to a country’s requirements. These mandates provide tax authorities with greater transparency, accuracy, and efficiency and move businesses towards a modern standard for invoice exchange that accelerates cash flows and bolsters economic vitality.

To date, more than 60 countries world-wide have implemented e-invoicing mandates and more countries are implementing mandates each year. While there are many similarities between these e-invoicing mandates, each country has its own specifications, which encompass the e-invoice format, required and optional fields, and exchange platforms.

"We are in a period of transition (...), the digital evolution in finance, spearheaded by tax digitization and e-Invoicing, is a change worth embracing. It is an investment in the future efficiency, accuracy, and strategic decision-making"

The benefits of e-invoicing

Are you ready?

When choosing an e-invoicing solution, ensure it meets the following requirements:

- Meets mandated CTC process - Integrates with Government Systems

- Supports mandated e-invoice formats - Validates e-invoice format, required data and optional data

- Validates tax amounts on invoices - Provides secure, authenticated data exchange

- Continuously updated cloud compliance information - Compliant storage of e-invoices

- Digital audit trail - Retains structured digital e-invoice (XML or other format) and human readable version

- E-invoice reporting - Fully integrated with your AP workflows

How Serrala can help your business stay globally compliant

Together, Sovos and Serrala provide an unbeatable combination of award-winning finance process automation and global e-invoicing and tax services to support finance organizations in their digital transformation journey where finance processes and tax compliance intersect.

Our integrated solution empowers your organization to meet corporate global compliance standards swiftly and effectively. It’s fast to implement and it can be flexibly adapted to your changing business needs. Supported by our global team of finance process, tax, and compliance experts, our solution ensures your financial operations remain efficient, compliant, and future-ready.

Benefits of Our Joint Solution

- Stay Compliant: Meet global e-invoicing and other tax and audit requirements in a single finance processing solution

- Save Time: Cloud-based solution is quick to implement and streamline compliance across SAP & other ERP systems

- Enjoy Flexibility: Pay for the services you need and extend to new countries or increase transaction volumes on demand

- Leverage our Experience: our team of global finance and tax experts can optimize your corporate compliance.