Steering Liquidity

A Top Priority to Improve Cash Flow Visibility for Decisioning and Strategic Planning

3 Essentials for Building an Effective Liquidity Strategy

Are you sure you really know your company’s cash and liquidity position, right now, and what it will be in a few months’ time…? Having daily visibility into the current cash and liquidity position as well as future cash needs is crucial for decision-making and strategy planning. Yet, for 48% of organization this is rather a wish than reality according to a recent survey. What is keeping businesses from gaining a better overview? Let’s explore the key challenges and solutions.

Key Challenges

Overcome the Challenges With 3 Steps

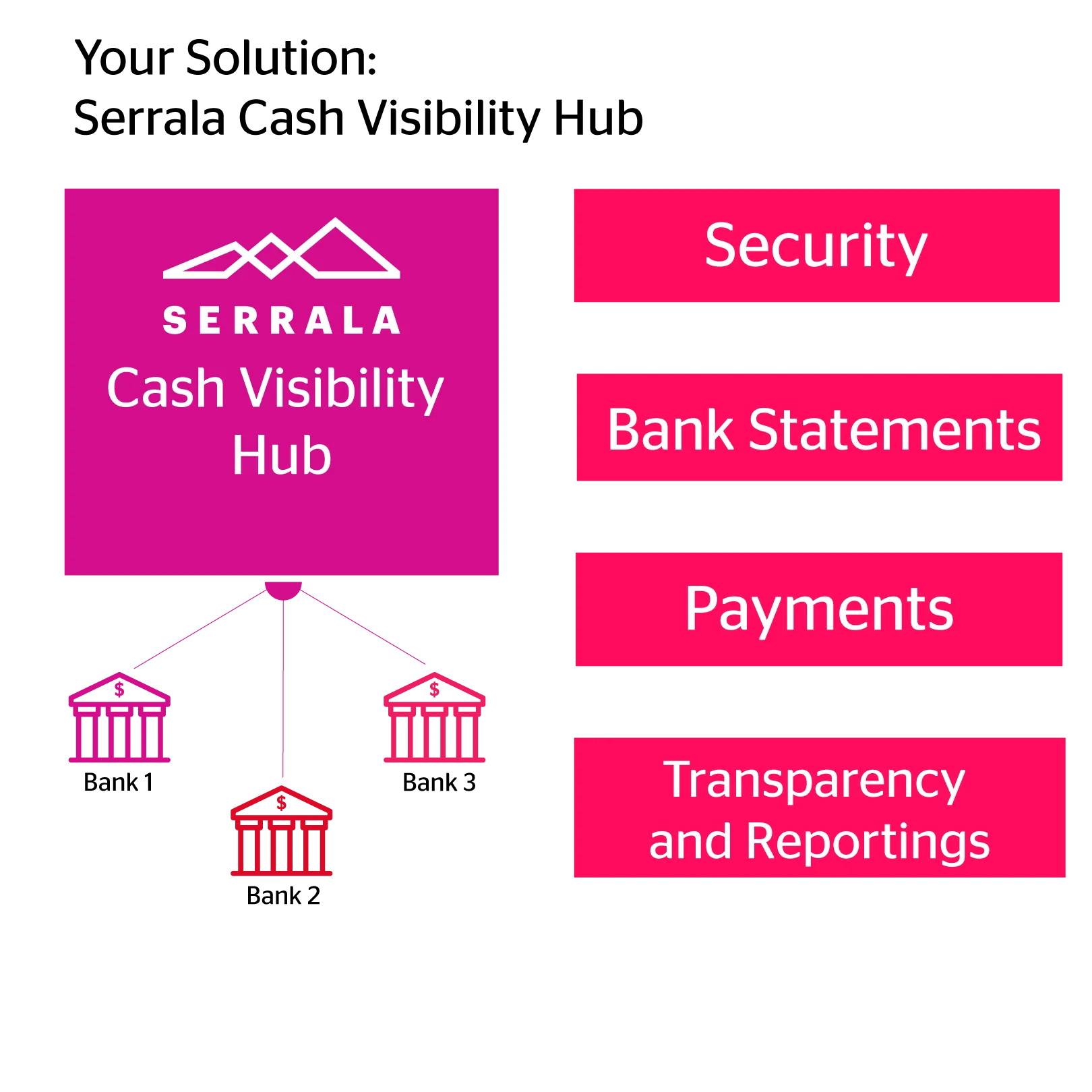

Payment centralization should be at the top of every treasury agenda. Centralizing processes within one system enables better control over payments. It is easier to harmonize processes and drive efficiency gains. Streamline your bank connections. Replace decentralized bank communication systems with a central payment hub. Simplify to one log-in, enable standardized authorization procedures, and provide a group-wide overview of payment transactions. Extend and bring in cash pooling, in-house banking, and payments on behalf of (POBO) step by step to achieve a full cash visibility hub.

Many treasury processes are ripe for automation from cash forecasting to bank account management, and payment processing. Automation leads to greater efficiency, allowing you to operate more effectively in a remote context. Your organization can achieve cost savings through faster invoice processing and capturing more early payment discounts. It prevents errors, duplicates, and fraud attempts within payment transactions.

Insights into cash and liquidity are essential for enhancing working capital and managing liquidity effectively. Process automation enables you to obtain these insights by capturing more financial data from a broader range of sources like your ERP and other systems. Integrating these systems end to end with your treasury supports your strategic decision-making. Benefit from automated pattern recognition and learn from historical data to generate more accurate cash flow forecasts with artificial intelligence and machine learning. Dashboarding makes the data visible in a central view and allows for easy analytics and reporting based on meaningful KPIs.

How Serrala Can Help

- Achieve full visibility and control over your company-wide cash and liquidity

- Centralize and optimize payments including easy bank communication with banks in 150+ countries

- Deploy end-to-end solutions that connect accounting and treasury to enhance efficiency and deliver deeper insights into cash

- Automate processes with AI and machine learning-enabled mechanisms

- Flexibly deploy solutions on premise, in the cloud, as a service or a hybrid model – they fit perfectly into your existing technical architecture today and in the future

- Navigate with confidence through your data with a modern user experience and central dashboarding

The challenges in cash management and forecasting have not changed over the years, but what has changed recently is the mindset. Organizations can only move forward with the right visibility and control over cash. Treasury has become more about steering liquidity in the best possible way and supporting the financial strategy of the organization. The office of the CFO is asking for more guidance and treasury is really pushing overcome the hurdles to deliver that. Serrala is there to help organization make that push.

100%

Cash Visibility

Up to 99%

Automated Assignment of Actuals

Over 100

Standard Treasury Reports

1 Central

Payment Hub

150+

Countries with Bank Connectivity

75%

Manual Intervention Reduction

Do You Have a Real-Time View on Your Cash and Can You Plan Ahead?

Increased Transparency, Visibility and Control

Knowing how much cash you have is key to overcoming any business hurdle and for sound planning. We saw some of our customers were missing transparency in their cash activity. With the Serrala Cash Visibility Hub, we focus on helping our customers to be nimble and flexible while providing robust and precise planning features. We collaborate with them to achieve three key success factors:

- Transparency: Dashboards, real-time cash status and forecasting is the basis for your decisions

- Visibility: Integration of bank statements and payments into one central location enables you to generate a holistic, company-wide view

- Control: Automated, standardized processes increase security and decrease fraud risk

Reliable and Comprehensive Liquidity Information

Customers, who are using the Serrala Cash Visibility Hub, have a real-time handle on all bank transactions and the execution of payments. They know all payment transactions are handled properly – with FS² CashLiquidity alongside, your existing finance solutions will be elevated to help you:

- Have a financial balance overview and forecast using accounting data (AR/AP, payment runs and more)

- Fully integrate your financial data into SAP – combining accounting with your treasury

- Easily integrate data from outside SAP

- Access your data from anywhere and with any device – the office, working from home, laptop or mobile

Selected Resources For You

Why Central Payments Transparency Is Key For Fraud Preventio...

Explore ways to leverage and expand your SAP capabilities with our S/4HANA-certified solution for better payments control.

Whitepaper: The Quest for Full Cash Visibility

Managing cash and risk exposures efficiently by achieving an accurate overview of cash positions and flows.

Podcast: Strategies for Driving Cash Visibility

TMI and Serrala talked about today’s challenges in treasury, best long-term strategies, and managing change.

How to Manage Change to Drive Cash Excellence

The pandemic has changed us and the way we work. Control over cashflows have become paramount to ensuring liquidity for the organization and treasurers have taken a seat at the decision-makers’ table.