5 Ways to Achieve Fully Automated Invoice Processing and Visibility in your AP Processes

11 minutes read

Published on 31-05-2023

If you are an AP or Finance leader, you know how critical visibility and automated invoice processing is in your AP processes. During times of economic uncertainty, outdated and manual processes are a challenge for AP departments because they prevent full visibility into vendor invoices and, importantly, decrease efficiency.

Late payments and missed discounts happen when businesses do not have a clear view of AP or lack an understanding of their financial obligations and cash outflows. Remote work has also complicated matters, making the need for fully digitized solutions that enable real-time tracking and remote access to invoicing processes a key asset.

In this blog post, we'll explore how to increase visibility across the entire AP process flow, by taking advantage of automated invoicing processing systems, optimized end-to-end processes, and real-time tracking and analytics. These improvements will put invoice status information at the fingertips of your AP department so they can quickly identify bottlenecks, improve efficiency, and ultimately reduce the overall time and cost of AP processing.

So, keep reading and learn about the 5 best practices we’ve seen our customers use to achieve improved visibility in their AP Process!

#1 - Get Rid of Paper

Although it seems obvious, reducing paper usage is a good starting point when looking to optimize AP processes. While going completely paperless might not be feasible, striving toward it can be beneficial.

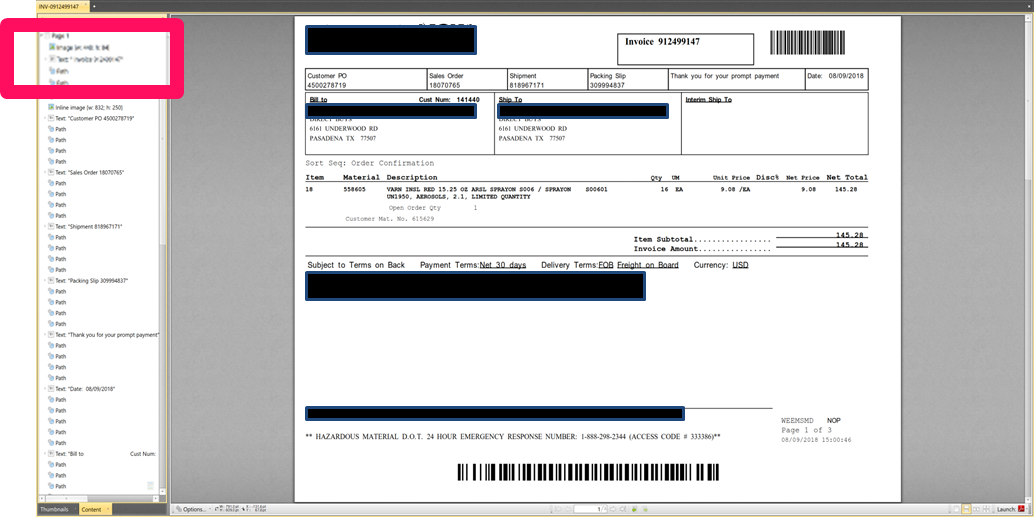

One effective method is requesting vendors to send digital invoice formats like XML, EDI (and some types of PDFs) that can be processed faster and more efficiently than paper invoices.

These digital invoices are machine-readable and can be captured and processed 24/7 without human intervention. Essential invoice information such as purchase order numbers, amounts, and vendor names can be extracted directly from them, reducing errors and minimizing the need for corrections, which will ultimately save your team time and headaches.

Eliminating paper also improves visibility significantly. Digital invoices are instantly available to the AP team, and they can be processed quickly with technologies like Robotic Process Automation (RPA), Artificial Intelligence (AI), and Machine Learning (ML). These technologies can automatically match digitized invoices to purchase orders or route them for approval or exception handling, which enhances process efficiency, ultimately setting the stage for automated invoice processing.

Having a company-wide view of invoices from initial capture until payment also makes it easier for AP departments to perform more value-added work. Teams can shift work across distributed groups, help plan for cash outflows, and capture discounts from vendors.

#2 - Meet New eInvoicing Standards

E-invoicing has become increasingly popular since the early 2000s when e-invoicing mandates were first introduced in Brazil (Nota Fiscal) and Mexico (CFDI). Now, these mandates have been implemented in over 50 countries, requiring companies to exchange digital invoices with government agencies (B2G), other businesses (B2B), and consumers (B2C).

E-invoicing is becoming more and more prevalent worldwide due to its many benefits. One of the main advantages of eInvoicing is its ability to improve the collection of taxes owed to the government. Notably, closing the VAT gap has become an important initiative for the European Union, for example. This gap represents the difference between the amount of tax a country is owed and what it receives. In the UK, it is estimated that the VAT gap is over 30%.

In addition to helping with tax collection, e-Invoicing mandates have also helped simplify tax reporting for companies, reducing the amount of time and effort needed to stay compliant. The risk of payment fraud is also reduced because e-invoices provide an additional layer of security and peace of mind for both buyers and sellers.

While the implementation of e-invoicing mandates may seem like a daunting task for AP teams, it can actually streamline their processes. This is because e-invoice formats are entirely digital and structured (XML), making them quicker and simpler to process. They are also validated by the government, which ensures that the tax information is accurate and makes audits easier.

As e-invoicing becomes a legal requirement in an increasing number of countries, global companies will need to prepare to process eInvoices even if they don’t operate in a country with a formal requirement. The benefit: increased visibility for you, your vendors, and your local tax authorities.

#3 - Optimize End-to-End Processing

Without an end-to-end automated AP process, it can be difficult to gain the visibility and real-time data required to make sound financial decisions. Tracking productivity, forecasting trends, and keeping a close eye on cash flow can be a time-consuming and manual process in AP environments. This is why fifty-six percent (56%) of Global Business Services centers that manage AP processing are moving to cloud solutions and prioritizing digital transformation.

Digital transformation in AP has some very concrete benefits; for instance, it helps build relationships and enhance efficiencies throughout the entire end-to-end process, which is essential for shared services centers. It also maximizes productivity by establishing one standardized and centralized set of processing rules, a clearly defined invoice status and sub-status structure, and standard approval levels by position rather than by a person. Defining clear rules for scrutinizing invoices of varying amounts and conducting regular risk assessments will ensure that digitized processes are fast, effective, and compliant for all AP team members globally.

#4 - Improve Straight Through Invoice Processing (STP)

Straight-Through Invoice Processing (STP) is the gold standard for AP processing. It is an automated process that requires no manual intervention during the receiving, processing, and posting of an invoice. STP is best suited for invoices that can be processed using simple business rules (i.e., 3-way match).

To increase straight through invoice processing rates, organizations need to ensure that accurate invoices, correct master data, and the right business rules are in place. This will enable the team to process more invoices with less effort.

The terms “auto-posting” and “touchless invoice processing” are often used interchangeably with STP but can also refer to any invoice that doesn’t require intervention from the AP team. It is important to understand the various definitions of these terms and establish clear expectations for straight through invoice processing within the organization.

The rewards for increasing STP automation include faster processing speeds, lower error rates, reduced costs, and faster vendor payments. AP departments can easily see which invoices have been posted and are ready to be paid. With more time to make payments, they can capture available discounts from suppliers, consolidate payments to vendors to save on payment fees, and exert more control over organizational cash flow.

#5 Optimize Reporting

The single best way for organizations to gain visibility into outbound cash flows and the AP process is to improve reporting. A recent report by SAPinsider shows that 68% of respondents view timely global cash visibility, automated invoice processing, and analytics as an essential requirement for their organization's cash management processes.

Reporting enables AP teams to identify areas of improvement and collaborate with other teams or vendors to enhance the end-to-end process. By providing real-time invoice status information and details on vendors, discounts, freight charges, and more, reporting empowers AP teams to make data-driven decisions and optimize their workflows. This leads to increased efficiency, better cost management, and improved vendor relationships.

Using standardized KPIs for accounts payable will enable teams able to monitor process performance over time and shift their reporting/KPIs as organizational objectives shift. Some of the top AP metrics to focus on include Days Payable Outstanding (DPO), supplier spend, exceptions, duplicate invoices, or payments. These metrics will help teams analyze payment delays, identify potential cost savings, prevent fraud, and reduce financial losses.

Achieving Greater Visibility and Automated Invoice Processing in AP

AP departments need to maximize visibility and improve automated invoice processing across the entire end-to-end process to enable real-time tracking of and remote access to invoices to prevent late payments or missed discounts. Digital transformation in AP helps teams achieve greater visibility as well as other benefits, including higher straight-through invoice processing (STP) rates, lower processing costs, and greater control over outbound cash flows. To realize these benefits, organizations should choose best-in-class automation solutions, which include the following capabilities:

- Comprehensive view of invoices globally

- Intelligently automated invoice processing

- Flexible business rules to drive automation

- Support for e-invoicing and other digital invoice formats

- Easy access to information online and to download/share for audit/vendor queries

- Anytime, anywhere approvals – Email, Web, Mobile, and MS Teams

- Robust reporting to drive continuous improvement

These solutions will enable organizations to improve processes and increase visibility so they can maintain healthy vendor relationships, ensure timely payments, and minimize costly errors.

Ready to update your organization's AP process? Our product team can help you learn which solutions are right for your needs. Request Live Demo

Award-winning solutions for financial automation

As pioneers in financial automation, Serrala offers a highly powerful and flexible suite of solutions that have successfully empowered finance teams all over the world to optimize and modernize their financial processes.